Easily Predict Bitcoin Price Using Automated Data Flow Technique 2025 - Minitab

Bitcoin Price Prediction:

Can you predict the price of Bitcoin?

Predict, Visualize, Analyze the power of your data to solve your toughest challenges and eliminate mistakes before they happen.

Data is everywhere these-days, but are you truly taking advantage of yours?

Minitab Statistical Software can look at present and past data to find trends and predict patterns, uncover hidden relationships between variables, visualize data interactions and identify important factors to answer even the most challenging of questions.

Visualizations are good, but pair them with analytics to make them great. With the power of statistics and data analysis on your side, the possibilities are endless.

With the rising popularity of Bitcoin, more and more analysts are attempting to develop a stronger understanding of this phenomenon. While it would be very difficult to create accurate predictions of the particular bitcoin prices, it's still possible to spot some interesting trends and relationships.

In what follows, I will be able to demonstrate the way to use the Minitab Predictive Analytics Module to accomplish this task.

The actual bitcoin data is offered from many public sources-One of the dataset could be downloaded here.

The dataset includes bitcoin statistics on commonplace going all the way back to 2009. on a daily basis is summarized by 44 different metrics, including bitcoin price, various fees, block count, transaction count, return on investment, and more. the complete data dictionary may be consulted here.

For the needs of our analysis, i'll observe the bitcoin daily statistics from January 1, 2015 to April 20, 2021. This eliminates a number of the sooner history which could detract from the foremost recent trends.

The dataset includes a variable called ROI30d – a percent return on investment for the asset assuming a procurement 30 days prior. In what follows, my main objective are to form accurate predictions of the 30-day return on investment using the remaining variables as potential predictors.

DATA SUMMARIES

First, let me have a fast have a look at various data summaries using Minitab.

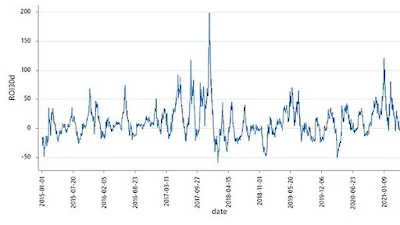

Below is that the statistic plot of the 30-day return on investment:

As you'll see, investing in Bitcoin can provide lucrative returns or significant losses. Given the volatility of this asset, timing of an investment in Bitcoin is critical to the return.

So knowing what impacts the return can help determine when would be the most effective time to speculate.

DETERMINING the foremost IMPORTANT PREDICTORS

So often we are asked questions and want to come back up with the most effective answer within the shortest amount of your time. With 44 possible predictors, i would like to understand which of them matter the foremost, and that i must are aware of it quickly so I can run an analysis.

That’s exactly why the Minitab Predictive Analytics Module has an option called “Discover Key Predictors.” this selection allows me to let the software identify the foremost important variables, enabling me to make a model that's still highly accurate and yet far less complex, making it way more user friendly.

I take my data set and run it through the TreeNet "Discover Key Predictors." needless to say, Minitab starts with the supplied set of candidate predictors and proceeds by building a series of models in sequence, and every subsequent model uses one less predictor by dropping the smallest amount important variable.

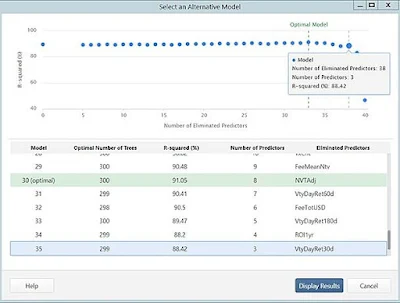

Thus, the whole process may be a modern generalization of the backwards elimination process known from classical regression modeling. Here is what happens after I start with the whole set of predictors (excluding date):

Looking at the graphical visualization of my possible models, you'll be able to see that the model accuracy fluctuates around 90% until only two predictors are left.

Once I penetrate the analysis, the "Discover Key Predictors" reveals that AssetEODCompletionTime is that the “last man standing” or the foremost important predictor.

Unfortunately, looking up its definition from the info dictionary, this “predictor” is solely the time the last data was collected every day, which isn’t a helpful metric.

As a result, I’d prefer to eliminate this because i do know – with certainty – that these are likely correlated but not predictive.

This is often not uncommon in predictor selection: often times the machine first selects a bunch of useless players. this instance also highlights the importance of pairing predictive analytics with material expertise. Fortunately, the answer is easy – just drop it from the starting list of variables and redo the “Discover Best Predictor” analysis!

After dropping AssetEODCompletionTime from the initial list and restarting the predictor discovery process, I obtain the subsequent summary:

Note that Minitab’s engine highlights that the optimal model uses 8 original variables (metrics) and achieves 91% R-squared on the five hundred test partition. this can be a wonderful performance result for a regression model of this type! Also note that there's a statistical variation within the model performances around 90%.

Minitab also gives me a helpful visualization that the general accuracy of models only drops significantly when the quantity of predictors falls below 3. For the sake of building the best model, while maximizing accuracy, i choose a model with 3 predictors for more detailed analysis.

Alternatively, you'll remove a number of these variables from the initial candidate list and redo the simplest predictor search to spot a unique subset of winners.

Remember, during this example I’m trying to spot what matters quickly. If maximum accuracy is your objective, you'd probably come with the optimal model, instead. The opportunities are endless, and regardless of what your objective is, you'll be able to accomplish it easily with only some clicks!

MODELING INSIGHTS

Back to my example. i'll now take a more in-depth observe the 3-variable model selected above. Here is that the summary performance of this model:

It appears that this metric tends to fluctuate between 1.0 and 4.0 with this values around 3.3 and possibly decreasing. Here could be a more detailed description on this metric from the information dictionary:

This provides you a ratio potentially indicating periods of overvaluation (when network value far exceeds its historical relationship to realized cap) and undervaluation. Realized cap could be a potent fundamental because it is understood because the cost basis for holders at a given time, therefore the ratio of the 2 indicates if as holders are underwater or not, giving insight into aggregate sentiment.

TreeNet gradient boosting model also reveals the character of contribution of this metric into the 30-day return on investment:

Recall, that the foremost recent values of this metric are fluctuating around 3.3 and can possibly continue decreasing. From the above dependency plot, it's clear that if this indeed goes to be the case then we expect the 3-day ROI still decline.

Alternatively, if there's any reason to believe that this metric goes to extend to three.7 and above, we would expect a big jump within the ROI, supported the historic pattern.

The above mentioned series of steps mimics a typical scenario encountered in predictive analytics. We started with a dataset containing 44 variables and quickly found the foremost important predictors in a very matter of minutes.

The Key Predictor Selection creates a short-cut to avoid the possibly tedious and laborious process of viewing each variable one at a time.

Furthermore, TreeNet gradient boosting model showed superb accuracy. All of this highlights the ability of contemporary predictive analytics and shows why you would like it moving forward!

Would you like to Run your own predictive analysis in Minitab Statistical Software?

No comments: